Keeping FQHC Accounts Receivable Clean: Tips and Strategies for Leaders

Keeping FQHC Accounts Receivable Clean: Tips and Strategies for Leaders

4 min read

Synergy Billing

Jul 11, 2023 7:00:00 AM

If you live and breathe the world of healthcare, you likely know that in Federally Qualified Health Centers (FQHCs), managing accounts receivable is crucial for maintaining financial stability and providing quality healthcare services to the community. However, the challenge lies in effectively collecting on AR that is older than 90 days. Over time, this can be frustrating and discouraging for health centers that are trying to serve their communities efficiently. Together, we will explore the impact of aging accounts receivable, strategies to keep them under 20%, and actionable steps FQHCs – yes, even yours! – can take to improve bill payment rates, ensuring bills are paid in full the first time.

Keeping Old Accounts Receivable under 20%

While we believe no AR is possible, 20% is a good rule of thumb and a good starting point for efficient revenue cycle management. Here are some effective strategies to help keep your aging receivables under 20%:

Steps to Improve First-Time Bill Payment

Improving first-time bill payment rates is key to reducing the workload associated with collections and nipping aging AR in the bud. Consider the following steps to enhance your FQHC's bill payment process:

What if my DAR is low but cash is low too?

You may be thinking that if your DAR number is low then your billing operation is both efficient and effective. This isn’t always the case. Especially if you are having cash flow issues. Write-offs and adjustments will reduce your overall A/R and in turn, could make the DAR metric appear more favorable than it actually is. To rule this out, FQHCs should review full balance adjustments.

What Should My Days-In-AR (DAR) be?

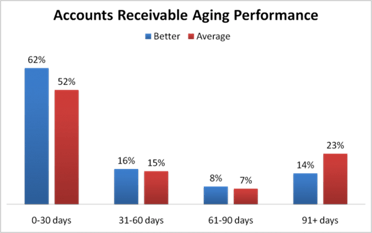

The answer to this question depends on a number of factors. Mostly your payer mix. Medicare usually pays about 14 days after receiving a claim. Some state Medicaid programs remit payment weekly. Meanwhile, some managed care carriers pay claims at 45 days after receipt, the time allowed by law in some states. When Synergy’s experts are reviewing performance, we use these guidelines:

Effectively managing aging accounts receivable is crucial for the financial sustainability of FQHCs. By implementing streamlined billing processes, reducing accounts receivable aging, and improving first-time bill payment rates, your health center can be better equipped to provide a better experience for your patients and more successful processes for your staff. Remember – AR isn’t necessarily a bad thing. AR within the 0 to 30-day range is acceptable. It is when AR begins creeping to a higher age than that that it gets a little more complicated. So, remain encouraged that there are solutions available to you and a road to a no-AR future, especially with Synergy Billing as your partner.

Interested in having a conversation? Give us a call at 877-242-8475.

.png)

Keeping FQHC Accounts Receivable Clean: Tips and Strategies for Leaders

.png)

Managing Accounts Receivable (A/R) effectively is essential for your Federally Qualified Health Centers (FQHCs) to thrive. One of the critical...

Get personalized assistance from our team